2023 Fortuna Advisors Value Leadership Report

The 2023 Fortuna Advisors Value Leadership Report reveals top-performing S&P 900 companies and …

The 2023 Fortuna Advisors Value Leadership Report reveals top-performing S&P 900 companies and …

The 2022 Fortuna Advisors Value Leadership Report reveals top-performing Russell 1000 companies…

When it comes to executive compensation, organizations want the approval of investors. And, sec…

Even though it can make certain metrics look better, merely letting assets depreciate isn't eno…

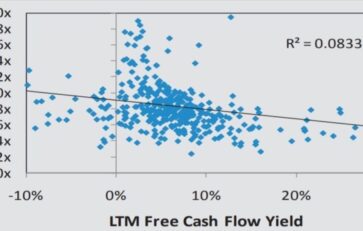

They're great for investment bankers and sellers, but lower valuation multiples are associated …

The past tells us nothing about whether we will fail or succeed in the future. Executives shoul…

To be a top value creator, a CEO must deliver a high total shareholder return in a large compan…

High returns, growth, and low leverage are common criteria. But capital intensity is also an im…

Far too many companies stress near-term profit and cash flow rather than investing in the busin…

Research on nonfinancial companies finds that larger companies typically grow more slowly and e…

What do Avery Dennison, Boston Scientific, Hasbro, and Pitney Bowes have in common? Each uses F…

Postmodern architecture builds on the open floor plan style that evolved during the modernist m…

ABOUT FORTUNA ADVISORS

Our team has advised hundreds of clients on developing a new approach to creating exceptional value for stakeholders and shareholders. Our differentiated cash-based earnings approach to strategic management and capital allocation draws on years of experience as advisors and investors at Credit Suisse, Morgan Stanley, Lehman Brothers, DLJ, Stern Stewart, Marakon, Ernst & Young, and ISS.

© 2021 FORTUNA ADVISORS – ALL RIGHTS RESERVED