Some interesting questions come to mind when discussing “valuation” multiples. We are rarely asked by management why their company is trading at a high valuation multiple. Often the concern is when they are trading at a low multiple.

This might suggest that a higher valuation multiple is better, but is it? And since total shareholder return (TSR) is what matters most to investors, do valuation multiples actually matter?

Perhaps high or low multiples are neither bad nor good, or perhaps it depends. Say a company has a total enterprise value (TEV) of $1 billion and EBITDA of $100 million last year giving it a 10x EBITDA multiple ($1 billion divided by $100 million). This year, the multiple is 20x, because TEV is still $1 billion but EBITDA has fallen to $50 million ($1 billion divided by $50 million). Does this mean that the company is trading at a premium? Or is it simply that the market believes the company will restore EBITDA back to $100 million?

Conversely, if the company increases EBITDA to $200 million, while TEV stays at $1 billion, resulting in a 5x EBITDA multiple, is that such a bad thing? Perhaps the market isn’t convinced that $200 million is sustainable, resulting in low expectations in management’s ability to continue current levels of performance. Or perhaps the company is simply trading at a discount providing investors with an opportune time to buy.

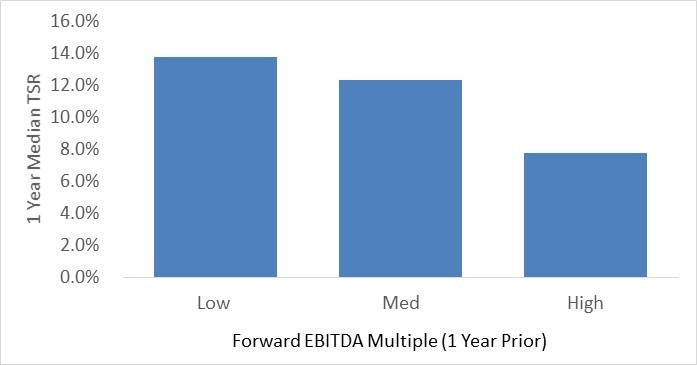

Apple, for instance, generated total shareholder returns of 53% over the trailing 12 months, while one year ago its forward EBITDA multiple was 8.3x. Compared to the rest of the Russell 1,000, that multiple was ranked in the 19th percentile, while its current one-year TSR is ranked 91st.

As I mentioned in a previous article, Avoiding the Mood Swings of Mr. Market, “Valuation multiples such as price to earnings (per share) act as the conduit for investors and observers to connect price to some indication of value. The term ‘valuation multiple’ is a bit of an oxymoron, however, given that valuation multiples are pricing models, not valuation models.”

For an investment banker or someone trying to sell a business, high multiples are great because they provide a basis for pricing a business at a premium. For investors, lower multiples are a great filter used to find assets that might be undervalued. In fact, many studies have shown that companies with lower valuation multiples tend to produce better TSR, and vice versa.

We recently tested that theory by analyzing the Russell 1000, excluding diversified financials. We grouped each company into tertile brackets (low, median, and high) based on their forward EBITDA multiple one year ago. We then calculated the median TSR as of the latest trailing 12 months. The chart below demonstrates that you would have more likely achieved a higher return one year later by investing in companies with a low versus a high forward EBITDA multiple.

What Do Multiples Tell Us?

So can any useful information be derived from multiples? In fact, yes. Through examination of valuation multiples using various methods of capital markets analysis, insights can be gleaned as to how much of TSR is driven by future expectations and how management may be able to meet those expectations through various value drivers.

The analysis takes on a different approach than a typical valuation methodology. Instead of asking whether the current share price is “fair,” we simply ask ourselves what expectations investors need to have in order to justify the current share price.

One way to do this is by using a discounted cash flow (DCF) model and solving back to the current share price. However, that’s extremely difficult, since free cash flow expenses the entire amount of capital in the period it is invested. Free cash flow can fluctuate widely from positive to negative values, making it difficult to determine the amount and timing of capital investment. A much easier and elegant way is by using a discounted cash flow-based measure of economic profit known as residual cash earnings (RCE).

RCE is an improved cash flow-based version of economic profit using a market-based required return on gross operating assets. It more accurately spreads the performance over the life of an investment. That mitigates the bias associated with a traditional economic profit measure, where investment can often be discouraged. With the right assumptions, a discounted RCE will always provide the same answer as a DCF, but has the advantage of showing which period’s returns will exceed shareholder expectations and how they tie back to drivers of value such as growth, margin, and capital efficiency.

By using an RCE model, we can work back from the share price to determine the expectations of value drivers embedded in a company’s market value. Such insight provides management with additional data points when planning budgets, determining where to deploy capital, setting financial policy, and uncovering which drivers will have the biggest impact on their share price.

For example, we’ve used this methodology to help our clients develop a rules-based approach to repurchasing shares and evaluate whether reinvestment back into the business was a better option. It has also helped clients, whose compensation is tied to TSR, determine the operational drivers that will help them meet their incentive goals.

So although a high or low valuation multiple may not be the goal, multiples can provide insights on how to achieve the goal of increasing TSR.

Marwaan Karame is a partner at the consulting firm Fortuna Advisors.