Surfacing the right insights from a growing sea of business data, financial results and market projections is critical to building confidence to make bold decisions and lead a company forward

HOW WE HELP

![]()

Performance Measurement

Develop a powerful new picture of performance and value creation with tailored metrics based on a company’s unique sources of value creation

![]()

Peer

Benchmarking

Benchmarking

Statistical approach to identifying your market-implied true peer set, and how performance accrues value within it

![]()

Value

Driver Diagnostic

Driver Diagnostic

A differentiated view of how growth, profitability, capital and reinvestment contribute to current and future value, and where to build a case for change

![]()

Managerial

Diagnostic

Diagnostic

Structured assessment of formal and informal organizational roadblocks to better managerial decision-making

![]()

Portfolio

Evaluation

Evaluation

Develop an economic map of the corporate and BU portfolio to identify where value is created and destroyed to inform strategic choices

![]()

Stakeholder

Value

Value

Build a stakeholder dataset to incorporate into financial and strategic decisions, and investor communications

![]()

Capital Management Policy

Gain insight on the link between strategy and decisions on leverage, liquidity, shareholder payouts and other policy decisions

Better Insights starts with building a deep understanding of the true earnings and value creation potential of the enterprise and its portfolio

KEY CLIENT IMPACT

SINGLE MEASURE OF VALUE

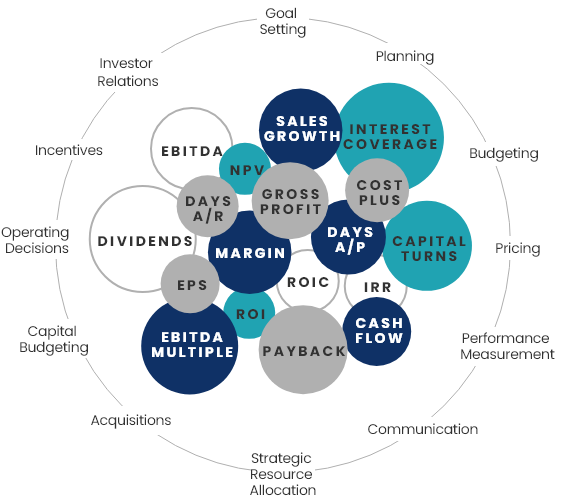

We take a structured approach that aligns measurable aspects of the business to a single value metric, allowing actionable insights that are consistent across the organization

Typical Company

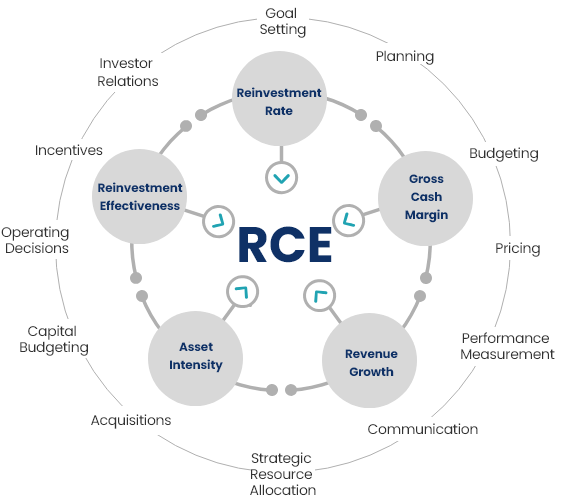

Fortuna’s Residual Cash Earnings Approach

THE POWER OF THE FORTUNA APPROACH

A sophisticated and accurate measure of value, yet simple enough to adopt and gain insight at multiple levels of the organization

KEY CLIENT IMPACT

ALIGNMENT WITH INVESTORS

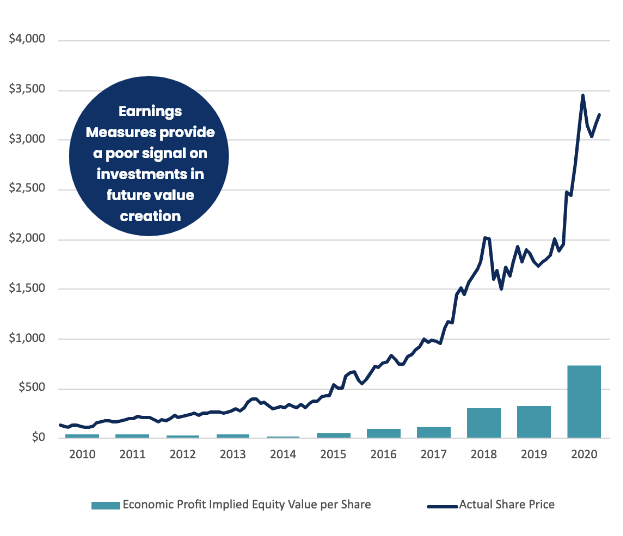

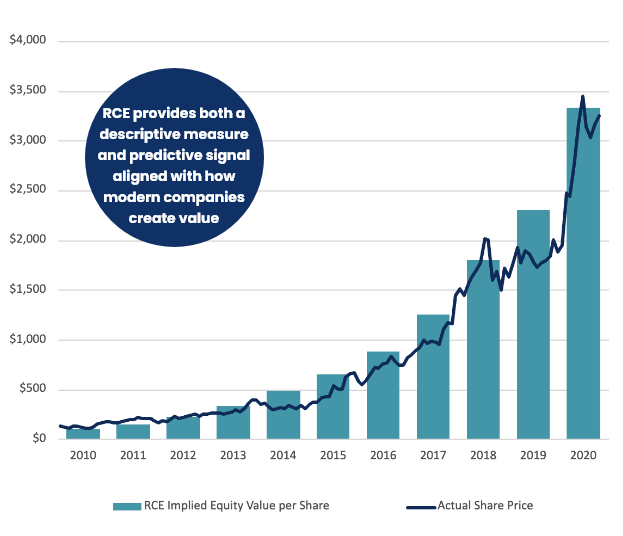

Companies benefit from a clear internal measure of value that aligns with both the direction and size of how the market measures value.

Case Study: Predicting Amazon’s Share Value

Amazon’s Predicted Value Using

Traditional Earnings Metrics

Traditional Earnings Metrics

EP-implied value calculated as net invested capital minus net debt plus capitalized economic profit in each year

Amazon’s Predicted Value Using

Fortuna’s RCE

Fortuna’s RCE

RCE-implied value calculated as gross operating assets (minus operating liabilities) plus capitalized residual cash earnings in each year

READ MORE ABOUT

DEVELOPING BETTER INSIGHTS

READY TO

Learn More?

Connect with us to discuss your company and

how we can find its catalyst for growth.

how we can find its catalyst for growth.

ABOUT FORTUNA ADVISORS

Our team has advised hundreds of clients on developing a new approach to creating exceptional value for stakeholders and shareholders. Our differentiated cash-based earnings approach to strategic management and capital allocation draws on years of experience as advisors and investors at Credit Suisse, Morgan Stanley, Lehman Brothers, DLJ, Stern Stewart, Marakon, Ernst & Young, and ISS.

© 2021 FORTUNA ADVISORS – ALL RIGHTS RESERVED

DESIGN BY BOLT UX