ADVICE BUILT TO DELIVER

Better Insights

Better Decisions

Better Behaviors

A UNIQUE FRAMEWORK TO MEASURE

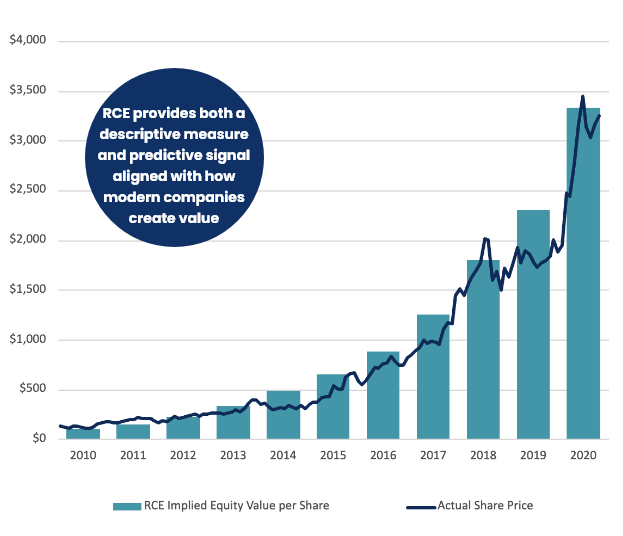

Fortuna developed its Residual Cash Earnings to better measure the true value of a company’s assets

and the true value of its earnings.

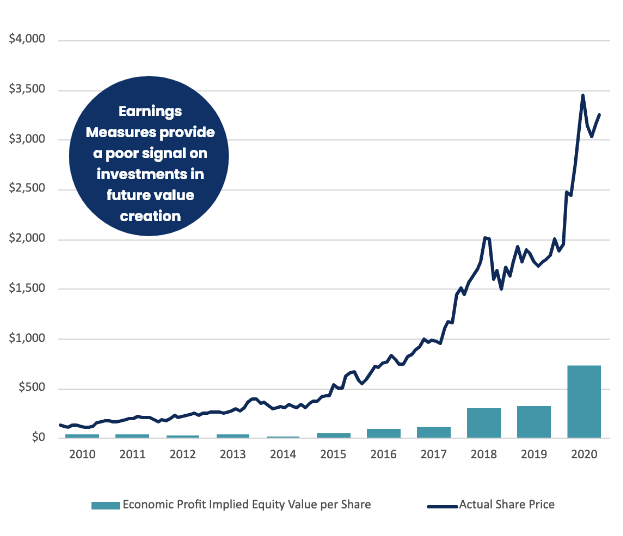

Traditional Earnings Metrics

A BOLD AMBITION TO AIM FOR

Framing the potential for TSR improvement helps set an aspirational objective to guide decision-making

We then work with companies to develop, test and execute strategies to deliver on their full value creation potential

Source: Capital IQ. Each dot = an S&P 500 company, ranked by percentile TSR performance in each 5-year period on USD basis

how we can find its catalyst for growth.

ABOUT FORTUNA ADVISORS

Our team has advised hundreds of clients on developing a new approach to creating exceptional value for stakeholders and shareholders. Our differentiated cash-based earnings approach to strategic management and capital allocation draws on years of experience as advisors and investors at Credit Suisse, Morgan Stanley, Lehman Brothers, DLJ, Stern Stewart, Marakon, Ernst & Young, and ISS.

© 2021 FORTUNA ADVISORS – ALL RIGHTS RESERVED