Creating Value Through Acquisitions When Capital Isn’t Free

How a company defines success influences whether acquired targets check boxes or create value.

How a company defines success influences whether acquired targets check boxes or create value.

Change management is no longer an event to be managed through; it’s a way of life that requir…

Today management teams must juggle multiple strategies to effectively reach customers; however,…

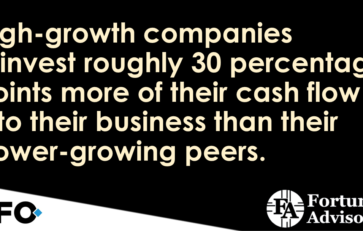

Successful capital allocation is pivotal to continually delivering shareholder returns.

Strong opportunity and accountability exist in an ownership culture and both public and private…

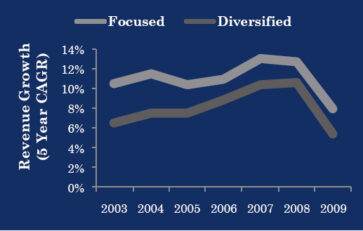

With an increase in corporate de-merger activity and the consistently positive market reaction …

What does your capital deployment strategy say about your growth expectations?

Buybacks can be an important tool in the corporate finance toolbox, but unfortunately the buyba…

To deliver shareholder value consistently, managers must operate within a system of continuous …

Performance measures typically used in annual incentive plans fail to align managers with the l…

Why do shareholders respond favorably to some acquisitions while others struggle to ever materi…

Many Diversified Companies are Breaking Up

ABOUT FORTUNA ADVISORS

Our team has advised hundreds of clients on developing a new approach to creating exceptional value for stakeholders and shareholders. Our differentiated cash-based earnings approach to strategic management and capital allocation draws on years of experience as advisors and investors at Credit Suisse, Morgan Stanley, Lehman Brothers, DLJ, Stern Stewart, Marakon, Ernst & Young, and ISS.

© 2021 FORTUNA ADVISORS – ALL RIGHTS RESERVED