Management teams of diversified companies should manage portfolio businesses in much the same way investors manage their portfolios — focusing their resources on segments and projects expected to yield the most value creation. Unfortunately, across our clients, we find that this is rarely the case. The reasons range from corporate politics to incomplete information to the simple inertia of prior resource allocations. While it may seem trivial, the opportunity costs implied by inattention to capital and resource reallocation are significant.

Residual cash earnings (RCE), an adjusted cash-based measure of economic profit, determines whether revenue covers (1) the cash-operating expenses captured in traditional earnings measures and (2) the opportunity cost of capital deployed, which we refer to as a capital charge.

RCE can be used to perform valuations of projects, business segments, and consolidated companies. The measure was developed to help companies align their performance measurement and decision-making frameworks with long-term total shareholder return (TSR).

The Importance of Reallocating

We often do an exercise to demonstrate the profound impact of reallocating resources. Below is a simplified version of the analysis. Consider a company with two business segments. Each segment produces the same amount of after-tax EBITDA. However, Segment A uses six times the amount of capital (gross operating assets) that Segment B does. Consequentially, Segment A produces $500 million less in RCE. As mentioned above, RCE is an economic profit measure calculated as after-tax EBITDA less a 10% capital charge on gross assets, which reflects an approximate cost of capital.

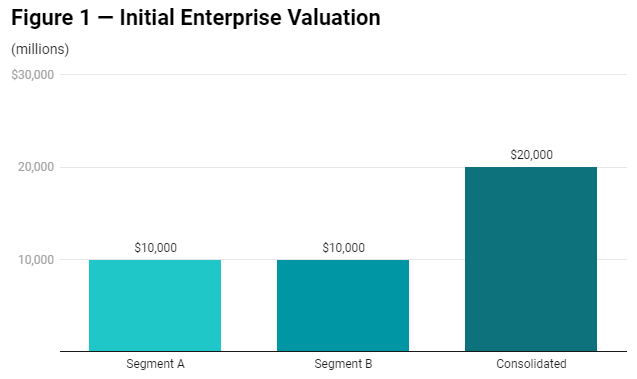

The valuation methodology is similar to a discounted cash flow (DCF) valuation. The valuation assumes the current year’s RCE (10%) will continue in perpetuity. That means all future investments will return just enough after-tax EBITDA to cover the capital charge. The RCE perpetuity is added to the asset base to arrive at enterprise value. Figure 1 shows that Segments A and B each make up half of the company’s valuation.

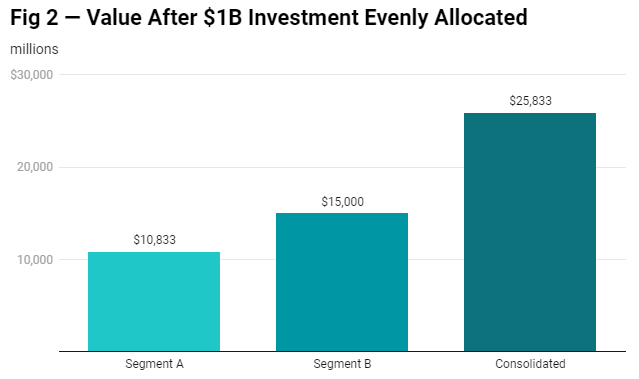

Over the next couple of years, the company plans to invest $1 billion. As often happens, the executive team decides to spread the capital evenly across the two segments. If we hold the return on investment constant, the equal distribution of resources produces the implied valuation in Figure 2. The enterprise value will rise by about $5.8 billion if all goes to plan.

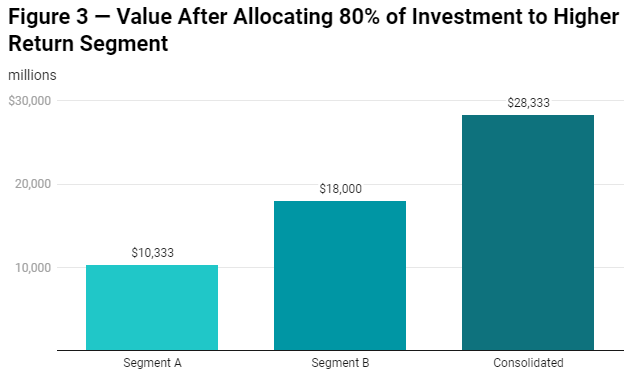

But let’s consider a case in which management directs more resources to the business that produces the greater value per dollar of investment. In that case, the management team allocates 80% of the $1 billion to segment B and only 20% to segment A.

As shown in Figure 3, the implied valuation improvement is about $8.3 billion compared with the case in which capital is evenly distributed. That’s an extra $2.5 billion of value created. The caveat is Segment B needs to have investment opportunities that carry the same 10% return in order to deliver the implied valuation improvement.

Why Efforts Fall Short

Successful resource allocation is pivotal to a company’s continuously producing shareholder returns. So, why do so many companies fail to take a differentiated approach to distributing capital?

The problem can stem from internal politics (management wanting to be equitable with the company’s capital), recency bias, or insufficient visibility into the value-creation track record and potential of business units. Some companies use incomplete metrics such as revenue growth, EBITDA, and return on invested capital (ROIC) to determine resource allocations. But they are employing measurement frameworks that lead to allocation missteps.

Value Measurement

Using measures that do not reflect the full economics of the business to inform allocations will cause management to allocate resources poorly. One of the most common measures used to determine the amount of capital allocated to a segment is revenue, particularly when it comes to R&D. Revenue is an important metric and an important part of the full value equation. However, looking at revenue alone does not factor in the cost of sales or the opportunity cost of capital.

Say Segment A in a company produces five times the sales of Segment B but produces far less value per dollar of investment. When the management allocates resources as a percentage of sales, segment A will get twice the R&D investment. This is true even though each dollar invested in segment B is expected to yield more value. As a result, the company could starve its future star businesses and potentially fall behind competitors quicker to compete in up-and-coming markets. This is also why some spinoffs become successful once out of the seller’s hands — the spun-off entity is no longer starved of capital and attention.

When employees get paid to improve a measure, their decisions tend to focus on improving that measure. However, if the measure is incomplete, it can lead to decisions that impede or destroy value. That’s why using the wrong measure can lead to poor resource allocation decisions.

All multi-segment companies should undertake the above allocation exercise to understand how to increase value by prioritizing resources more economically. Once the importance of that is understood, companies should tackle any of the other obstacles to better resource allocation. Ultimately, resources should go to the segments and projects that deliver the most value per dollar of investment.

Frank Hopson is a partner at Fortuna Advisors and Jason Gould is a senior associate.