Since 2010, Fortuna has been at the forefront of research on buybacks. In 2019, Fortuna launched VIBE®, a Value Inspired Buyback Execution service.

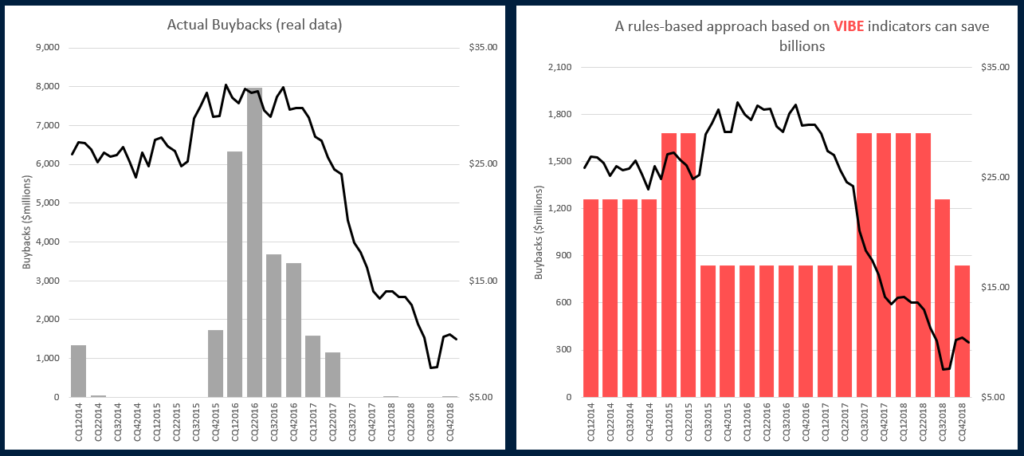

Many companies view buybacks as a way to boost EPS and provide value to remaining investors. But unfortunately for these shareholders, this doesn’t always work out as planned. Companies tend to buy back much more stock at the peaks of business and share price cycles, and less when it’s most likely to provide the most benefit in leveraging a company’s performance.

This is not conjecture — we’ve done the research to prove it. Out of a sample of the S&P 500’s 370 largest repurchasers, 64% of companies bought back more shares when their share prices were relatively high over the five-year period ending in 2018. In other words, two out of three companies are leaving substantial value on the table by not using a carefully measured framework to execute repurchases based on key metrics and business, product, and market cycles.

The average company in our sample spent $7.7 billion over the last five years, and could have saved over $1.9 billion while retiring the same number of shares with top-quartile versus bottom-quartile buyback timing. The sheer size of this forgone value was the reason we developed our VIBE service.

How VIBE Works

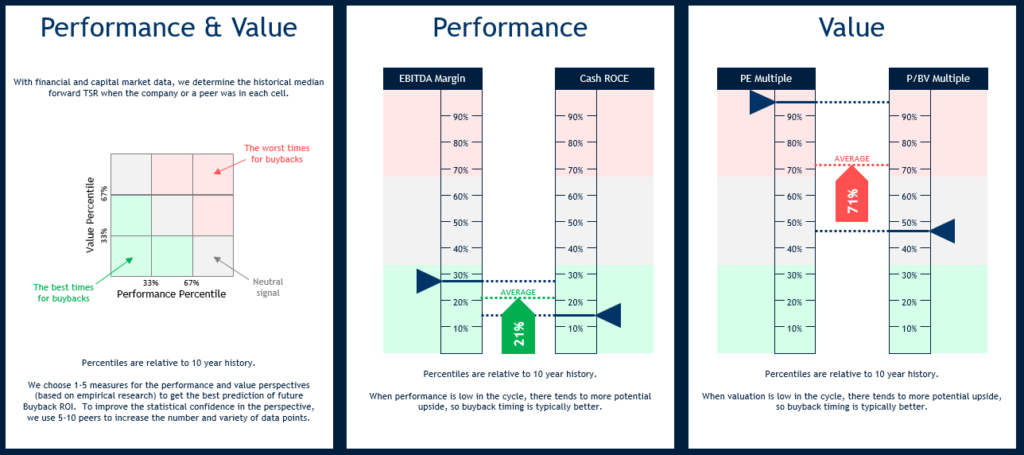

VIBE Works by using four key metrics to empirically analyze the desirability of buying back stock at any point in time. These perspectives include:

1. Performance and Valuation:

We develop a customized grid based on company and peer performance and valuation that signals the likelihood of a forward-looking Buyback ROI that is above a customized hurdle rate. This analyzes where a company sits within valuation and performance cycles, and extrapolates that information into whether remaining shareholders are likely to be better or worse off from buying back shares at the current date.®

2. Consensus vs. Price Perspective:

We estimate expected EPS to determine the share price that implies a capital gain CAGR that, combined with the dividend yield, predicts an “Expected Buyback ROI.”

3. VIBE simulation of value:

We generate a distribution of future possible share prices based on 1000+ simulations with empirically derived variances in growth, margins, and asset intensity.

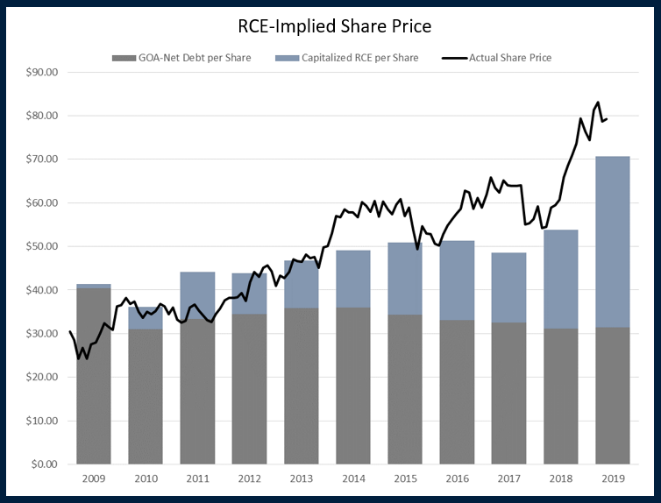

4. RCE-Implied Premium Discount:

We compare the actual share price to that implied by Fortuna’s Residual Cash Earnings (RCE) measure. We have carefully developed RCE over more than a decade of research, which has shown it to be an improved measure of valuation given its ability to capture not only growth, but effective management of the balance sheet and efficiency in using investor capital.

VIBE indicators can help companies buy more when the share price is below average and less when it’s relatively high, to capture more value for remaining shareholders. VIBE’s signals can be applied to an entire buyback program or part of it, and can be implemented into ASR rules and documentation.

VIBE provides clear actionable outputs, including “cutoff prices” for optimal timing. It begins with a customization process, and all data inputs and outputs are updated monthly by Fortuna, with Smart Tools to refresh signals between formal updates. VIBE keeps companies informed about their buyback prospects as value-creating opportunities emerge, and can improve the overall corporate capital deployment process.

Innovating Buyback Measurement

In 2011, Fortuna developed Buyback ROI to track and measure the value achieved (or lost) through share repurchasing programs. The idea was that it could be compared to the historical performance of other investments. But starting last year, we began helping companies look forward too. Using our VIBE models and framework to project Buyback ROI, companies can now also weigh buybacks against traditional investments to determine their most efficient use of capital.

Buyback ROI is calculated as an annualized internal rate of return (IRR) that views the amount spent on buybacks as the “investment,” and the dividends saved on the repurchased shares plus appreciation of (or loss on) the retired shares as the return. Buyback Strategy is a measure that tells us whether a company bought back shares during a period when its share price was generally rising (or falling), and reflects the company’s total shareholder return based on share price appreciation and dividends over the period. Buyback Effectiveness is simply the compounded difference between Buyback ROI and Buyback Strategy, and reflects the overall timing of repurchase programs.

Fortuna Buyback Reports

For the third consecutive year, Fortune magazine has published our annual Buyback ROI ranking of the S&P 500’s largest share repurchasers. In our buyback reports, we measure the individual buyback performance of companies, comment on general trends in buybacks over the last five years, and unpack the insights provided by the proprietary metrics we developed to analyze repurchasing programs.

2024 Fortuna Advisors Buyback ROI Report │ Bloomberg TV: Fortuna CEO Greg Milano on buybacks

***

For more information, or to sign up for our VIBE service, please reach out to Greg Milano (gregory.milano@fortuna-advisors.com)

how we can find its catalyst for growth.

ABOUT FORTUNA ADVISORS

Our team has advised hundreds of clients on developing a new approach to creating exceptional value for stakeholders and shareholders. Our differentiated cash-based earnings approach to strategic management and capital allocation draws on years of experience as advisors and investors at Credit Suisse, Morgan Stanley, Lehman Brothers, DLJ, Stern Stewart, Marakon, Ernst & Young, and ISS.

© 2021 FORTUNA ADVISORS – ALL RIGHTS RESERVED