by Gregory V. Milano, Fortuna Advisors; Brian Tomlinson, Chief Executives for Corporate Purpose

The role of the corporation in society is under review. The paradigm that corporations are run solely in the interests of shareholders, which has defined a generation of management practice, is being contested. The emerging paradigm references “stakeholders” as the broader group that managers should consider in decision-making.

Boards seeking to embrace “stakeholder capitalism” should start with corporate purpose, a whole-firm concept that flows through the organisation from the board to the brands (and all employees). Just as individuals should display strong personal character, corporations must demonstrate that they have an authentic purpose, how it was arrived at, how it impacts the way the business is managed and overseen, and how the company interacts with key stakeholder groups.

Structuring for purpose

To fully benefit from purpose, corporations need to operationalise purpose throughout their business management processes. Directors should familiarise themselves with the emerging practices that corporations can adopt to embed purpose with clarity.

Firstly, structure for open stakeholder engagement. If companies are taking a stakeholder approach, management teams need to identify and prioritise the needs and preferences of key stakeholders and implement stakeholder feedback mechanisms. One technique for stakeholder transparency is to disclose a stakeholder-focused materiality assessment with explanatory commentary on how it was developed, how it is overseen, and how regularly it is refreshed. In addition to external visibility, it is important to articulate how such insights inform internal decision-making.Many institutional investors have indicated that the board should own and oversee purpose, as part of framing the strategic direction and stance of the company

Secondly, develop a board-issued statement of purpose. An early and emerging approach to purpose are board-issued purpose statements. Many institutional investors have indicated that the board should own and oversee purpose, as part of framing the strategic direction and stance of the company. A board-issued purpose statement formally identifies the key stakeholders that it holds in view, how it plans to oversee their outcomes, and the time-horizon over which the company sets strategy and manages the business.

Thirdly, convert purpose into teachable moments. Some companies have identified the key elements of their corporate purpose and its origin story; through salient examples, derived from the core business, these companies communicate how the stated purpose affected management’s decision-making. This approach makes it clear that purpose “lives” in strategy development and decision-making.

As executives and directors develop, manage and oversee purpose, success can be improved by designing purpose-centric metrics into compensation structures; in the same way that material ESG issues are featuring in elements of compensation as performance on those themes is increasingly becoming a management imperative.

Purposeful brands drive performance

Consumers are increasingly biased toward brands they perceive to act with purpose by seeking out purpose-driven companies that appear to reflect their personal values, beliefs, and impact objectives. In response, many companies are establishing deeper connections with consumers by aligning purposeful practices across their lines of business and brands with environmental or social impact. A growing body of research indicates that purpose-driven companies are associated with a variety of performance benefits. Our study—The Return on Purpose—reinforces these findings.

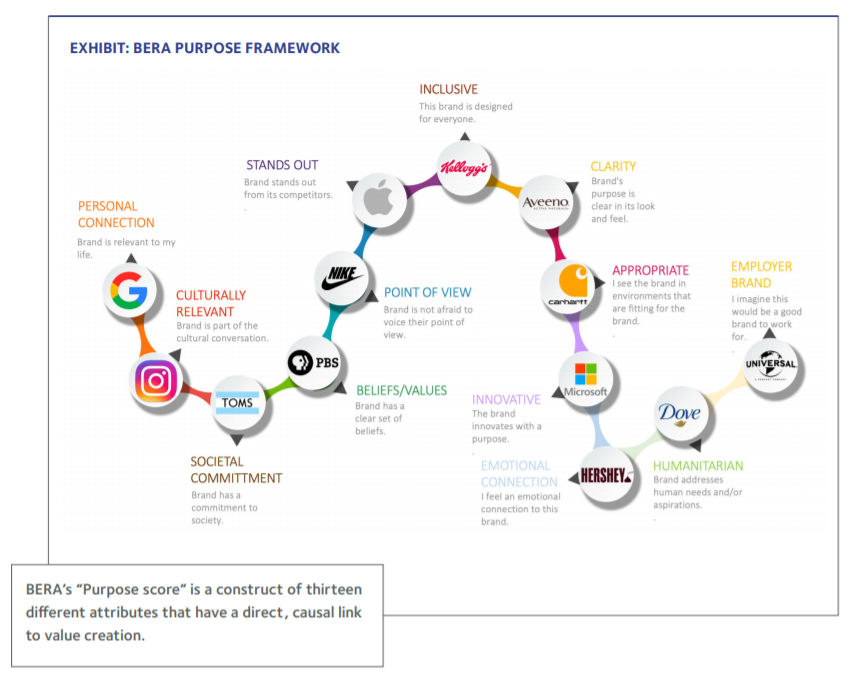

We used a new corporate purpose metric, developed by BERA Brand Management, in collaboration with the Jim Stengel Company, to analyse the impact of corporate purpose on company financial performance, market valuation and shareholder value creation. The “purpose score” is a construct of thirteen different attributes of corporate purpose that have a direct, causal link to value creation, including Social Commitment, Cultural Relevance, Point of View and Inclusivity. We used these attributes to sort our universe of mono-brand companies, where the majority of the revenue comes from one brand, into High Purpose and Low Purpose cohorts.

Study findings

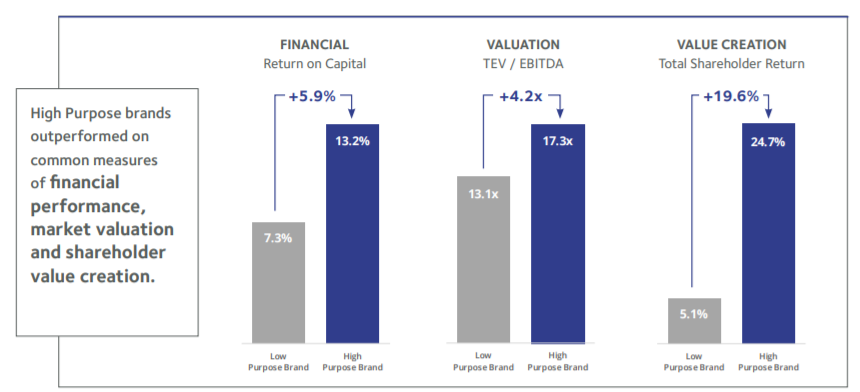

We found that high purpose brands significantly outperformed on common measures of financial performance, market valuation and shareholder value creation. Better financial performance (+5% ROIC) and better valuation multiples (+4x EBITDA) combine to deliver better long-term shareholder value creation, as evidenced by the nearly 20 percentage point advantage in annualised total shareholder returns for companies with High Purpose scores versus those with Low Purpose scores.

These findings make intuitive sense. When the corporate purpose is more closely aligned to consumer preferences, companies can spend less per dollar of revenue to acquire and serve that consumer than will a company that is misaligned with consumer preference. As a company grows, consumer acquisition costs tend to increase with the need to reach beyond early adopters. Companies must consider how to engage with and build relevance to a broader consumer group. So long as competition for those consumers remains, companies that better engage with their consumers should outperform.

We tested what these performance relationships looked like during the Covid crisis. We found that high purpose companies outperformed low purpose firms by an even wider advantage during the crisis. We saw that the outperformance of high purpose brands was driven, in decreasing order, by those that had the best personal and emotional connections to consumers, that treat employees well, were culturally relevant, and that innovate with purpose.

We accept that there are companies that have achieved financial and even stock market success via strategies and tactics that seem at odds with the ideals of corporate purpose and that may take advantage of, or harm, some stakeholder groups. However, our study suggests that those examples are not the norm.

Corporate purpose has the potential to create value across stakeholder groups; though we do not see the stakeholder value paradigm as a world free of trade-offs. Quite the opposite—it requires a clear strategic vision to decide who and what to invest in and why. We also acknowledge the scepticism that the dialogue around corporate purpose generates. Building on the good work of others, our study suggests corporations that develop and demonstrate a clear corporate purpose are well positioned to realise a return on purpose over the long term and through the uncertainty of crises.

Gregory V. Milano is founder and CEO of Fortuna Advisors and Brian Tomlinson is director of research of the CEO Investor Forum at Chief Executives for Corporate Purpose (CECP). The authors would like to thank Alexa Yiğit, sustainable finance lead at the CECP CEO Investor Forum and Riley Whately, Fortuna Advisors, who co-authored the study.