Despite all the focus on improving governance practices in recent years, directors still have a large opportunity to help management teams improve their ability to shape organizational culture. A meticulous survey of more than 1,300 executives in the United States and Canada found less than half believed the board contributes to their culture’s effectiveness. The research also revealed an enormous gap between knowing and doing: while 92% of executives said improving their culture would increase firm value, only 16% felt their culture was “where it needs to be”. And more than two-thirds agreed that “leadership needs to invest more time in the culture.”[1]

Culture’s central role in durable business outcomes

While definitions of organizational culture vary, most focus on the shared beliefs, values, and norms that affect daily interactions and decision making. People learn their company’s culture primarily by observing and experiencing the consequences of actual behaviors. Employees watch how leaders behave, which colleagues get promoted, who’s listened to in meetings, and how managers assign choice projects. Statements of values, mission, and vision matter, but actions teach more powerful and longer lasting lessons.

Directors and senior executives need to pay particular attention to aligning their words and actions. A recent survey asked more than 1,300 participants across 42 countries if “our leadership team walks the talk on purpose, values, and culture.” There was a 27% percentage point deficit between how the board and C-Suite self-evaluated versus how subordinates saw their behavior.[2]

Achieving superior business performance depends critically on how well culture aligns with the formally designed elements of an organization: strategy, structure, systems, and processes. Michael Porter wrote compellingly about the importance of combining mutually reinforcing activities into an “activity system” (what we now call a business model) to create differentiation and defensible competitive advantage.[3] It’s clear that culture forms an integral part of successful business models. The same aspects that make culture difficult to observe clearly and to change – embedded beliefs and unwritten rules – mean competitors also have a hard time replicating an effective corporate culture. Empirical research finds cultural strength can persist for a decade or more, according to a recent study that used natural language processing (NLP) to analyze company reviews posted on Glassdoor by current and former employees.[4]

The well-worn saying “culture eats strategy for breakfast” – often incorrectly attributed to Peter Drucker – implies that strategy and culture are in competition, when they need to be complementary. James Heskett suggests we instead “think of an effective culture as one that provides a platform, in the high-tech sense of that word, one that is designed to foster the ability to learn, adapt, innovate, and change anything, including strategy.”[5] From this perspective, a sustainable culture should support a succession of strategies over time.

While decisions about organizational structure often require trade-offs, effective cultures compensate for these compromises by encouraging people to do what’s right for the business. In most companies, informal networks evolve to help employees get things done despite official reporting relationships. Conversely, processes like performance management, recruiting, and training should be crafted to “fit” with and reinforce the desired culture.

Consider these characterizations[6] from senior executives that bring home the centrality of culture:

Culture is like the tendons and ligaments that hold the body together and allow it to be healthy as a body and execute daily.

Culture is your sheet music to success. It is no different than an orchestra. You can hire the best trumpet players, oboist, violinist, and unless they are all playing from the same sheet of music at the right tempo, you will fail.

Like a body without tendons and ligaments or an orchestra without music, companies without an effective culture are doomed to underperformance – or worse.

Culture deserves a seat at the top table

While culture’s role in superior performance by companies such as Microsoft, Costco, and Netflix has been well-chronicled – as have culture failures at Rio Tinto, Samsung, Volkswagen, and Wells Fargo – many boards have not elevated their oversight of culture to the same levels they devote to strategy, risk management, compensation, and succession planning. These case studies confirm a host of academic and practitioner research documenting the links between effective culture and business outcomes.[7] As directors survey a current landscape that includes the “great resignation,” geopolitical distress, inflation, and the pandemic’s long tail, now is the right time to refresh board practices around culture.

One example of a necessary mindset shift where board directors can lend their expertise to reshape corporate culture by changing obsolete ways of thinking, is around supply chain planning:

- Scenario planning should routinely incorporate “once-unimaginable tail risks”

- To build resilience, apply a just-in-case approach to inventories, moving beyond hyper-efficient but brittle supply chains

- Use “lateral, rather than tunnel, vision” instead of optimizing your supply chain in isolation. Take a broader view and consider shared nodes that could become bottlenecks, such as the port of Los Angeles.[8]

In addition to the market forces driving directors to get more involved, the big three institutional investors – BlackRock, State Street, and Vanguard Group – are holding boards accountable for overseeing culture and human capital management.[9] The UK Corporate Governance Code is explicit that boards should “establish the company’s purpose, values and strategy, and satisfy itself that these and its culture are aligned.”[10] Given culture’s importance to strategy execution, innovation, diversity, acquisition integration, and risk management, if directors get a better handle on culture, all their other jobs will be a little easier.

Culture happens, with or without you

Without proactive leadership, cultures evolve from the bottom up in fragmented ways when individuals and teams interpret senior management’s intentions on their own as they try to resolve uncertainties in organizational structure, systems, and processes. For example:

- Incentive design often uses a menagerie of metrics like revenue growth, margin, cash flow and return on capital. There’s rarely clear guidance on which to prioritize and when, so managers tend to be risk averse when it comes to making investments that promote long-term growth but may have short-term costs. This is particularly acute for intangible investments that are expensed through the P&L, such as R&D, brand building, and training.

- In matrixed organizations where individuals have multiple bosses – say, for geography and product line – which activities they prioritize may depend more on political clout than what’s best for customers.

Outlining the board’s culture oversight action plan

What are the right building blocks to guide the board’s engagement on culture? Specific tactics vary based on the company’s current situation, directors’ backgrounds, and the board’s relationship with the CEO, but every plan needs to address these topics:

- Understand your current culture. What are the firm’s stated values and how do they translate into actual behavioral norms? Asking this fundamental question will highlight management’s approaches to monitoring employee engagement, the quality of information available, and the strength of alignment with strategy, structure, systems, and processes. The phrase “unwritten rules” is frequently used in culture discussions, but directors can help the CEO make unspoken assumptions explicit by exploring core beliefs and ingrained behaviors.

- Articulate the desired culture. How does our culture need to change to deliver on our strategy aspirations, execute our operating model, and implement necessary transformations? For example, cutting edge digital business models require a learning mindset to enable new skills. The desired culture will be an evolving target as markets shift, leadership priorities change, and people adapt.

- Stress-test management’s change plan. The CEO and team should have a rigorous change management plan for migrating toward the target culture. This is also where any misalignments identified in Step 1 are remedied. The plan will also address material interactions with other major change initiatives.

- Establish protocols for ongoing oversight. The board’s plenary agenda for each meeting should include a fulsome culture review. And each committee needs to regularly consider how culture interacts with their responsibilities, particularly the Compensation, Audit, and Governance standing committees. For example, culture must be weighed heavily in CEO selection; Spencer Stuart found that lack of cultural fit is responsible for up to 68% of new-hire failures of senior executives.[11]

- Align the board’s own culture. How directors interact and the “tone at the top” directly affects board effectiveness and reinforces (or detracts from) the desired company culture.

Case study: Transforming an ownership culture

A disguised example illustrates how directors can assemble and implement a practical approach to overseeing culture. After TechCo’s share price had underperformed the market and its peers for several years, the board took stock of the current state:

- Management failed to deliver on its growth and margin promises for several years, and investors were skeptical of a turnaround.

- R&D productivity was key to long-term value creation but had chronically lagged competitors’ results.

- TechCo closed a large acquisition in its core business six months earlier. Reducing leverage taken on for the deal was a key priority.

Understand TechCo’s current culture

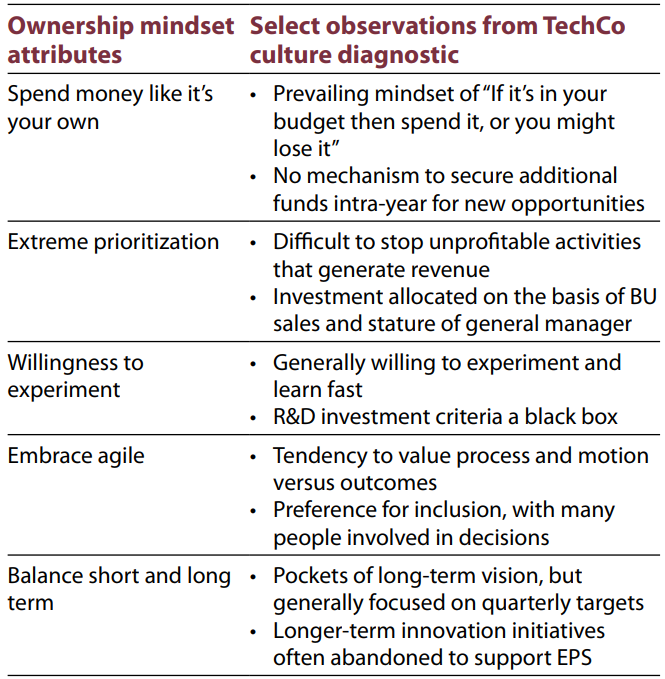

The board and CEO decided to begin by diagnosing TechCo’s culture using Fortuna Advisors’ ownership lens. We conducted one-on-one interviews of the executive team and their direct reports, supplemented with online surveys. The table below summarizes our observations.

Delving into the results, we discovered:

- While TechCo’s clearly stated corporate values included an “owner’s mentality,” behavior across the organization did not live up to the official words. Our surveys found a credibility deficit of more that 30% between how well the executive leadership team felt they “walked the talk” on values, and the perspective of rank-and-file employees.

- The divergence of the acquired company’s values and norms from TechCo’s was insufficiently addressed during integration planning or implementation. For example, the newcomers preferred to fully analyze each decision before moving forward. This frequently caused tensions with legacy TechCo employees who were more comfortable acting with imperfect information.

- TechCo’s incentive system for senior management included many metrics – revenue growth, margin, free cash flow, and ROIC – with little guidance on how to reconcile conflicts among them. The company was organized along functional lines, and each function prioritized different measures: margin for Manufacturing, revenue in Marketing, and cash flow in Finance. Moreover, this encouraged Marketing to make optimistic sales forecasts so as not to lose revenue, which regularly depressed Manufacturing’s margins from writing off obsolete inventory.

- Most managers were evaluated using personal scorecards with 15-20 quantitative and qualitive goals, but they were inconsistently held accountable according to their supervisor’s judgement. This behavior went all the way up to the CEO.

Articulate the desired culture

The board and CEO agreed to begin a multi-year journey toward an authentic ownership culture, where each of the five attributes would be encouraged through clear communications, executive role modeling, customized training, and aligned processes. Directors also examined the likely effects of the target culture on key stakeholders: employees (attracting talent, engagement), customers (brand equity), and investors (execution, competitive differentiation).

Importantly, the board replaced the multiple metrics in TechCo’s Annual Incentive Plan with one measure: a streamlined, cash-based version of economic profit we call Residual Cash Earnings (RCE). In addition, annual RCE performance targets were set solely based on improvement from prior year’s actual results. The CEO and CFO embedded RCE in core planning and resource allocation processes, including annual budgeting, quarterly operating reviews, corporate development, and strategic planning.

Stress-test management’s change plan

Directors considered the CEO’s change management plan with the same thoroughness they would a major acquisition integration or crucial strategy shift. They fully vetted the plan before signing off, then reviewed progress with the full board at each meeting.

Establish protocols for ongoing culture oversight

The board encouraged management to establish a regular cadence for surveying alignment with the target ownership culture, as well as a broader set of behaviors that included trust, collaboration, and risk management – and senior management’s ability to “walk the talk” of its stated cultural values. Directors reviewed this survey data and feedback from ongoing employee training sessions during their regular discussions of the change management progress. Committee chairs for Compensation, Audit, and Governance amended their respective charters to clearly reflect the importance of culture in their mission and responsibilities.

Align board culture

The lead director initiated a revision of TechCo’s board by-laws to give oversight of company culture the same level of attention as strategy, risk management, budgeting, and financial reporting. Their self-assessment process also included evaluation of the board’s effectiveness in shaping culture.

Proactive boards drive outperformance

Building an effective organizational culture that bolsters competitive advantage requires the board and executive team to be at the top of their games. Forward-thinking CEOs leverage their directors to fully deploy culture as a powerful management tool. Culture oversight must take its place alongside the board’s other essential responsibilities: CEO selection, compensation, strategy, and risk management.

Jeffrey Greene helps clients achieve superior long-term shareholder returns through better resource allocation decisions by improving performance management and shaping culture. He can be reached at jeff.greene@fortuna-advisors.com.

References

[1] Graham, John R. and Grennan, Jillian and Harvey, Campbell R. and Rajgopal, Shivaram, Corporate Culture: Evidence from the Field (January 28, 2022). 27th Annual Conference on Financial Economics and Accounting Paper, Columbia Business School Research Paper No. 16-49, Duke I&E Research Paper No. 2016-33, Available at SSRN: https://ssrn.com/abstract=2805602

[2] Global culture survey 2021: The link between culture and competitive advantage. (n.d.). Retrieved April 14, 2022, from https://www.pwc.com/gx/en/issues/upskilling/global-culture-survey-2020/pwc-global-culture-survey-2021.pdf

[3] Porter, Michael E. (Fall 1996). What Is Strategy? Harvard Business Review.

[4] Wu, K. (2021, August 25). Measuring culture. Sparkline Capital. Retrieved April 14, 2022, from https://www.sparklinecapital.com/post/measuring-culture

[5] Heskett, James L. (2022). Win from within: Build organizational culture for competitive advantage. Columbia University Press.

[6] Graham, John R. and Grennan, Jillian and Harvey, Campbell R. and Rajgopal, Shivaram, Corporate Culture: The Interview Evidence (October 10, 2016). Duke I&E Research Paper No. 2016-42, Columbia Business School Research Paper No. 16-70, Available at SSRN: https://ssrn.com/abstract=2842823

[7] For example, see: Groysberg, Boris and Lee, Jeremiah and Price, Jesse and Chen, J. Yo-Jud (January-February 2018). The Leader’s Guide to Corporate Culture. Harvard Business Review; Heskett, Win from within; Wu, Measuring culture.

[8] Tett, Gillian. “Supply Chain Crises Force Corporate America into a ‘What If’ Mindset.” Financial Times, 31 Mar. 2022, https://on.ft.com/3DpeVMB.

[9] For example, see: Blackrock.com. 2022. Our approach to engagement on corporate strategy, purpose, and financial resilience. Available at: https://www.blackrock.com/corporate/literature/publication/blk-commentary-engagement-on-strategy-purpose-financial-resilience.pdf. Accessed 14 April 2022; Ssga.com. 2022. Human Capital Management Insights. Available at: https://www.ssga.com/us/en/institutional/ic/insights/human-capital-management. Accessed 14 April 2022; Global.vanguard.com. 2022. Investment Stewardship 2020 Annual Report. Available at: https://global.vanguard.com/documents/vanguard-investment-stewardship-2020-annual-report.pdf. Accessed 14 April 2022.

[10] UK Corporate Governance Code. Retrieved at https://www.frc.org.uk/directors/corporate-governance-and-stewardship/uk-corporate-governance-code

[11] Groysberg, The Leader’s Guide to Corporate Culture.