Faced with substantial new desirable investment opportunities, a CFO of a client company of ours recently chose not to cut her substantial share-repurchase program to fund the investments. Instead, she chose to finance the new outlay by slashing investments in two other businesses, both of which were growing well and earning strong returns. She missed an opportunity to step up the rate at which the company reinvests in itself to drive its share price higher over time. Value is not created solely by maximizing returns on capital, but by balancing the pursuit of higher returns with an adequate emphasis on investment in future growth.

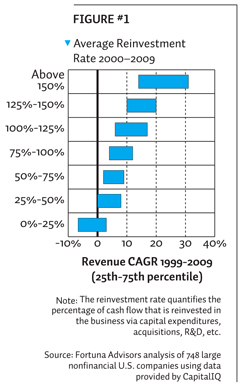

How much cash flow does your company reinvest for the future? Using the “reinvestment rate,” which quantifies the percentage of cash flow that is reinvested in the business, can be a good way to gauge that amount. To calculate it, add capital expenditures, acquisitions, research and development, and other investments. Next, divide that sum by earnings before interest, taxes, depreciation, and amortization (EBITDA), plus R&D and rent, less taxes.

Top-line growth is, obviously, an important driver of total shareholder return (TSR), which reflects the stock price change plus the dividends paid during a period. What may be less intuitive is that sustained growth is typically the result of having a higher reinvestment rate. My associate Jeff Routh and I found that the highest reinvestment-rate companies delivered higher compound annual growth rates (CAGR) of revenue over the decade ending in 2009. (See Figure #1.) Our sample was the largest 1000 non-financial U.S. companies, excluding those not public for the full decade.

Top-line growth is, obviously, an important driver of total shareholder return (TSR), which reflects the stock price change plus the dividends paid during a period. What may be less intuitive is that sustained growth is typically the result of having a higher reinvestment rate. My associate Jeff Routh and I found that the highest reinvestment-rate companies delivered higher compound annual growth rates (CAGR) of revenue over the decade ending in 2009. (See Figure #1.) Our sample was the largest 1000 non-financial U.S. companies, excluding those not public for the full decade.

Granted that high reinvestment rates drive more revenue growth, however, is value really being created? Our capital market research demonstrates that the highest reinvestment rate companies delivered better TSR over the decade ending in 2009. (See Figure #2.)

Granted that high reinvestment rates drive more revenue growth, however, is value really being created? Our capital market research demonstrates that the highest reinvestment rate companies delivered better TSR over the decade ending in 2009. (See Figure #2.)

The benefits of reinvestment are so significant that of the 277 companies that reinvested more than 100% of their cash flow for the full decade, over 200 of them delivered higher TSR than the median of the 0-50% reinvestment group. This outperformance by high reinvestment companies is particularly noteworthy considering the tough economic and stock market environment of the decade.

The reinvestment rate is an important driver of TSR and should be a prominent and deliberate strategic discussion point. The goal should not be to maximize the rate of return but to balance the pursuit of higher returns with adequate reinvestments in growing the business. Although larger companies may find it difficult to match the reinvestment rates of small companies, many companies I have recently worked with would benefit from a higher reinvestment rate than where they are now.

Our findings indicate that this is not a superficial stock market effect in which investors arbitrarily assign higher multiples to high reinvestment companies. In fact, it is quite the contrary. While high reinvestment typically boosts TSR over time, it does not improve price-to-earnings or enterprise value-to-EBITDA multiples. High reinvestment does not boost valuation at a point in time. Instead, it drives value appreciation over time. Unfortunately, executives that are too fixated on current valuation multiples may tend to underinvest.

I have met many finance executives at companies with low reinvestment rates that understand and agree with our findings that high reinvestment rates are good. But they claim they don’t have many opportunities for profitable reinvestment. One CFO defended his position by stating he “never turns down positive net-present-value [NPV] investments.” Upon deeper review I found their culture and internal processes overemphasizes avoiding bad investments. All but the highest-return investments are never even proposed for corporate consideration. In many companies, arbitrarily tight capital expenditure budgets set a strategic tone of restraint which in turn sets the bar very high in the minds of operating managers. Such stifling cultures need to change if finance executives want to adequately promote desirable growth investments.

Is the reinvestment rate more important for companies that earn high internal cash-on-cash operating returns but less so for those with low returns? In our research, we found that whether you have high, medium, or low returns, TSR is positively correlated with higher rates of reinvestment. (See Figure #3.) As we would expect, however, high-return companies get a larger benefit from reinvestment than low-return companies.

Is the reinvestment rate more important for companies that earn high internal cash-on-cash operating returns but less so for those with low returns? In our research, we found that whether you have high, medium, or low returns, TSR is positively correlated with higher rates of reinvestment. (See Figure #3.) As we would expect, however, high-return companies get a larger benefit from reinvestment than low-return companies.

Some may question the causality in our findings that high reinvestment companies typically achieve higher revenue growth and higher TSR. Are the successful companies the only ones who can afford to reinvest more? Do the “good” industries artificially make reinvestment appear desirable for all? We have conducted extensive research in our client studies of their individual industries including health care, industrial, energy, technology, and other sectors, and the results are generally consistent everywhere.

Are you reinvesting enough? As our economy strengthens, CFOs should assess their companies’ reinvestment rates to ensure enough capital is being deployed to build future value via capital expenditures, R&D, and maybe even acquisitions. Within your company, examine the reinvestment rates across business units to see if enough reinvestment is occurring where the returns and opportunities are highest.

To ensure your corporate culture supports adequate reinvestment, review all business management processes and eliminate biases against reinvestment. Consider adding the reinvestment rate to planning and performance-measurement processes. In doing so, avoid measuring and benchmarking investment as a percent of revenue, since that creates a bias in favor of less profitable businesses.

Always measure the reinvestment rate as a percentage of “pre-investment” cash flow to assure the signals reinforce making adequate investment in the most profitable businesses. Constantly reinforce this in planning, capital investment, and performance review meetings. Make sure everyone understands that value is not created from maximizing returns, but from balancing the pursuit of higher returns with investment in future growth.