Early stage biotech companies often go public before they are profitable and often require additional capital to fund research, development, and commercialization. The question of whether to raise more capital through a public secondary offering or to partner with a large pharmaceuticals company (a.k.a. a “big brother deal”) is a decision that can have important but hard-to-quantify ramifications for existing shareholders.

These big brother deals can provide the early stage company with more than just capital. Big brothers can provide domestic and international marketing, distribution, and sales, while allowing for the developing company to maintain its corporate independence and entrepreneurial culture. These deals can also provide substantial benefits to large pharmaceutical companies that face expiring patents and an inadequate pipeline of new medicines and treatments. In many cases, small biotechs are an important source of innovative drugs and an incremental pipeline. If all goes well, they also may become acquisition targets.

For the small biotech, the allure of a big brother deal is amplified when faced with the alternative of a secondary equity offering that would dilute shareholders. However, our research shows this often-absolute aversion to shareholder dilution may, in many cases, be an overreaction.

Fortuna Advisors recently completed a 2017 health-care shareholder value project linking total shareholder returns (TSR, which is equal to dividends plus share price appreciation) to a multitude of strategy, capital deployment, financial policy, and performance metrics. The study included about 100 health-care companies in rolling 3-year cycles over 16 years. Surprisingly, the percentage change in the number of shares outstanding proved to be a very important positive influence on TSR.

To be clear, we do not believe issuing shares creates value, but, rather, that the positive TSR relationship is due to the desirable nature of the drugs, products, indications, or markets associated with the use of proceeds. In other words, on average the value of what a company invests in more than outweighs the effects of dilution. Nevertheless, this might be surprising to many who view shareholder dilution as something to be avoided at any cost.

So how does a small biotech company decide between a secondary equity offering and a big brother deal? While a secondary equity offering may be dilutive, the potential cost of relinquishing distribution rights on current and future offerings to a big brother might be an even greater cost to shareholders.

Forecasting is hard for any business, but for early stage biotech companies the future is even harder to predict. The range of outcomes is quite wide, which makes common corporate-finance-based decision methodologies like net present value rather difficult to apply.

An alternative framework for evaluating and making such decisions begins by developing a baseline forecast of investor expectations that reconciles to the current share price. Although no one can predict the future, the share price of a company can provide insight into what future might be expected, on average, by investors. The process begins by assuming that a secondary equity offering and the commensurate share count increase is already reflected in the share price. Young biotechs are typically losing money and burning cash, so they could not survive without additional financing. It is reasonable to assume, therefore, that investors are already pricing future dilution into the market capitalization.

Since free cash flow (FCF) mixes profit and investment cash flows, it is hard to settle on a forecast that is acceptable. We prefer to use a cash-based economic profit measure, known as residual cash earnings (RCE), which is the after-tax EBITDAR (earnings before interest, tax, depreciation, amortization, and R&D) less a capital charge for the gross operating assets (GOA) of the business.

GOA includes gross property, plant, and equipment; other operating assets; and capitalized R&D. RCE allows us to more easily estimate the implied expectations of growth and return “baked” into a company’s share price, and devolve this into expectations for revenue, margin, and investment. Staged probabilities of success can be included as well.

Once we’ve established the baseline forecast, which again includes the secondary offering, we layer in the big brother deal terms, which include upfront payments made by the big brother and such factors as shared revenue, costs, and R&D investment. Importantly, the share price dilution goes away as well.

Once such an analytical framework is established, the deal terms can then be stress tested to develop negotiating strategies and tactics for the big brother deal. In the end, the higher the share price, the more likely it will be that the secondary offering will be desirable. At higher valuations, fewer shares are sold and the cost of dilution goes down. In addition, at higher share prices the embedded forecast is higher, making the cost of a big brother deal higher. Conversely, at lower share prices a big brother deal is more likely to be desirable for existing shareholders.

The final step, as with all decisions, is to apply judgment. Although CFOs can’t predict the future, they can ask, “What must I believe for one alternative to be better than the other?” This can be as simple as a breakeven probability of success or it can be a more complex breakeven forecast. Knowing the conditions that will favor one alternative over the other provides management with clarity on how to make the decisions and, if the big brother deal is desired, a strategy on how to negotiate the best deal possible.

Gregory V. Milano is the founder and chief executive officer of Fortuna Advisors LLC, a value-based strategic advisory firm. Marwaan Karame and Joseph Theriault are partner and vice president, respectively.

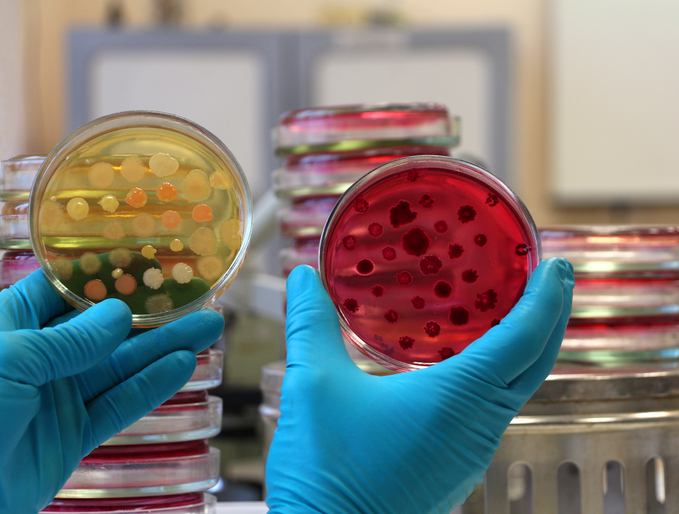

Image: Thinkstock