Some think of utilities as a homogenous group that produce steady lackluster returns for shareholders. It is true that on average over the business cycle, utilities earn lower returns than the overall market, but the returns earned by utilities vary considerably.

If you had invested $10,000 at the end of 2012 in each of the 29 utilities that are currently in the S&P 500, the best investment would have grown to be worth $30,335 by the end of 2017, while the worst would have been worth only $9,233. That’s more than a 25% difference in annual return, so utility results are quite varied.

To understand utilities, it is important to recognize at least the basic nature of regulation.

Among many other powerful mandates, the regulators of public utilities have broad authority to influence utility management by reviewing and approving investment strategies and plans, overseeing environmental matters, and controlling or guiding pricing. The nature of the regulation varies across electricity, natural gas, and water, but they all face oversight and scrutiny beyond that encountered by many other businesses. This influences everything from strategy selection to business management processes and organizational culture.

There are various forms of price regulation, including rate-of-return regulation, price-cap regulation, and revenue-cap regulation. Although they each work differently, they all reduce the incentive for utilities to strive for cost efficiency and capital productivity. Most utility executives feel a responsibility to the greater community, not just to shareholders, so they generally aim to make conscientious decisions. But the requirement to transfer performance improvements to consumers can be demotivating, so utilities are generally not as efficient as they could be.

Consider the choice between two activities that are influenced differently by regulation.

If activity A generates a profit that we get to keep, it may be favored over activity B that generates twice the profit but where we need to give the activity B profits back to the consumer in the form of a reduced price increase. A very real example of this would be the profits that result from earning a reasonable return on the investment of capital. Utilities generally get to keep those earnings as long as the capital is in the approved capital plan. The creation of profits through some sort of organizational process improvement that reduces cost, on the other hand, would typically be given back in the next rate negotiation.

Regulators usually seek to encourage good investment in the utility to improve the efficiency and reliability of the network, so allowing the company to keep a reasonable return on such investments makes sense. But does this, at least in some cases, lead to unnecessary gold plating? In other words, are there times when engineers might install $10 million worth of equipment where a $5 million solution would have done the job?

There are probably few engineers or executives that would deliberately invest more than needed, but at least subconsciously there is less pressure on capital productivity so the incentive to find the least expensive solution is less than it would be in an unregulated company.

The nature and degree of regulation is changing in many states, though this process has evolved with fits and starts over the last 25 years with occasional retracements caused by unsatisfactory outcomes, such as the 2000 California energy crisis. Though it may be a slow and bumpy road, many experts project there will be a general trend toward deregulation of parts of the utility network. Those that will be successful in a deregulated environment will likely be those organizations that learn to act more and more like an unregulated business, even before the regulatory shackles are removed.

Motivating Continuous Improvement

At Fortuna Advisors, our research across the broad stock market shows that growth and improvements in percentage measures such as margins and rates of returns have the strongest correlation to total shareholder return (TSR). So, the managerial emphasis must be on continuous improvement. But how can we motivate continuous improvement when so many of the improvements are taken away by the regulatory process?

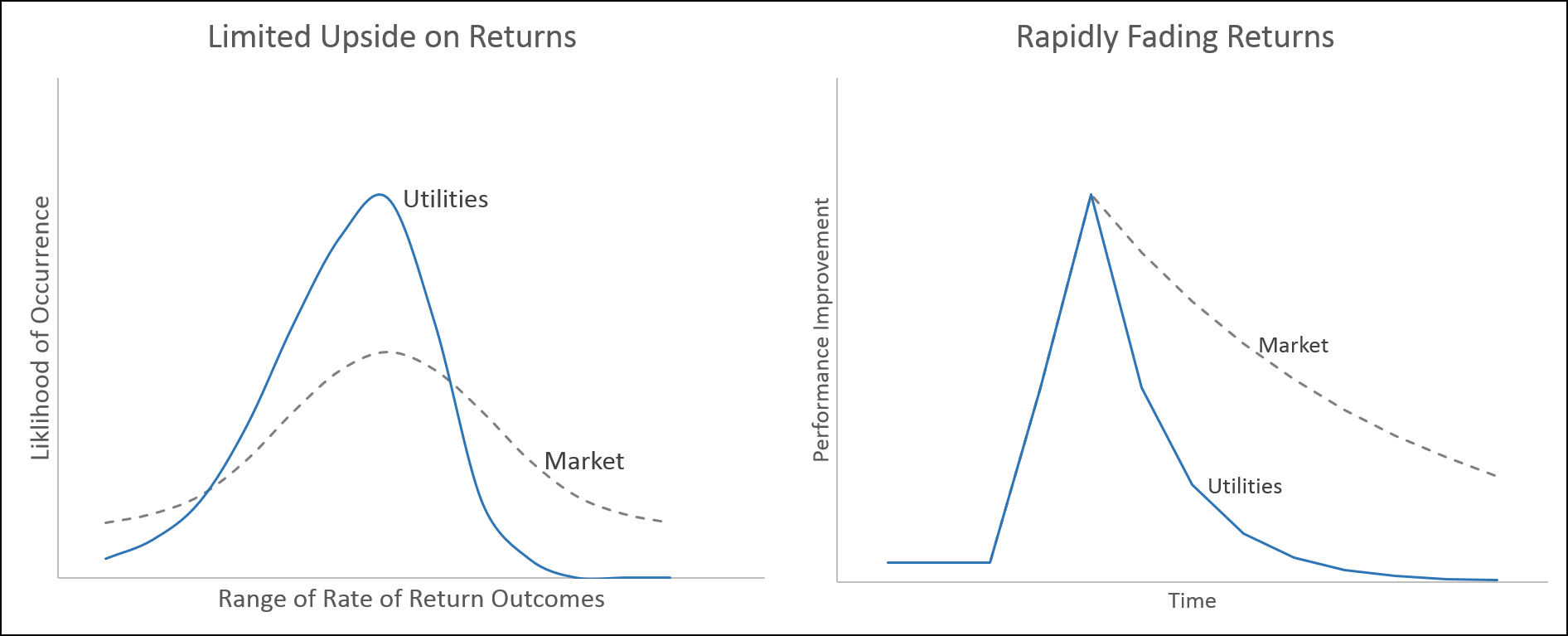

Though it varies from utility to utility, there is a practical limit on the rates of return on capital that can be earned by regulated utilities. In addition, when improvements are generated, they tend to fade faster in utilities, due to regulatory rate negotiations, versus what happens in a typical unregulated business where competition drives more gradual fading over time. Both of these utility characteristics are illustrated in the figure below. It is this combination of limited upside and rapidly fading results that is unique to utilities. In some sectors, such as tech, competition can be fierce and returns can be pressured down rapidly, but at least while a company has a competitive edge they can earn many times their cost of capital. Not so for utilities.

This creates a motivational and behavioral challenge across utilities that inhibits value creation for customers, employees, and shareholders. If management tries to improve returns by being more efficient and productive, the realized improvements are limited, and can only be sustained for so long. As a result, there are subdued motivations to deliver improvements and everyone suffers.

To improve performance measurement and realign the behaviors that are motivated requires a more holistic view of what is good for the utility. Focusing solely on shareholders leads to undesired behaviors, so we need to cast a wider net. We must comprehensively capture the performance benefits, whether or not the shareholders get to keep them.

At Fortuna Advisors, we developed residual cash earnings (RCE) almost 10 years ago as a cash on cash economic profit measure. The specific definition varies by company, depending on the business model and accounting policies, and must be customized for a utility. In essence, though, RCE measures cash earnings in excess of earning a required return on investment, and the improvement in RCE trends relate well to TSR. On the surface, it would appear this wouldn’t work for utilities that are specifically designed to earn up to an acceptable return and no more. When we dig deeper, however, there are two important considerations that together make RCE an effective tool to motivate better managerial behavior.

First, just because there is a limit on how high returns can generally go, it doesn’t mean that all companies earn their allowable return. Indeed, normal business problems and project failures sometimes lead to subpar returns and these are indeed born by shareholders.

The median return on equity (ROE) for the 29 utilities in the S&P 500 was 9.2% in fiscal 2016, which is about two-thirds of the median for the overall S&P 500. Only two utilities had an ROE at least 5% above the utility median while four, or twice as many, had ROE at least 5% below the median. So, there should be a focus on RCE, even if only to motivate management to avoid situations that cause returns to decline.

Second, and far more importantly, we have the ability to tailor our measurement of RCE to motivate improvements in efficiency and productivity whether or not they are shared with the customers.

If a utility measured the improvement in RCE each year based on “adjusted product and service prices” set equal to the prior year prices plus an objective measure of inflation, it wouldn’t matter to management if the improvements could be kept or not, because the total value creation can now be measured and recognized. Any improvements in efficiency and productivity would be of value to management even if they benefit only the customers and not the shareholders. We could even adjust the required return on capital for favored investments such as those in clean energy solutions, to ensure the prioritizations are right.

To actually implement such an approach requires complex tradeoffs, but clearly a solution is possible and the behavioral benefits could be immense. If properly designed, there would be more incentive to invest in value-creating projects, more incentive to drive organizational efficiencies, and a more holistic view of what it means to be successful.

To close the loop on the major stakeholders, this innovative approach to utility performance measurement could be used for executive incentives and beyond that could be considered as the basis for a profit sharing plan that would essentially unite the interests of customers, employees, and shareholders.

Given the trend toward deregulation, such an approach could begin to transform the business processes for planning, budgeting, strategic resource allocation, investment decision making and performance measurement inside utilities, so management and employees could begin acting like a deregulated business even before deregulation occurs. Developing the organizational culture and skill set to be more competitive will be a significant advantage in running operations, getting the most out of acquisitions, and being a leader if and when regulation is relaxed.